The Limits of CCU For Measuring Game Success

Both game devs and players are obsessed with tracking concurrent user counts for popular games. But is it really the best metric for measuring success? We asked devs and publishers to weigh in.

Every creative industry has its preferred metric for measuring success, for better or worse.

Hollywood has “box office gross.” Netflix has “hours viewed.” And Spotify has “most streamed.” The games industry is no different. As the games business has transitioned away from retail, many players and armchair analysts have begun paying special attention to the data provided by digital platforms like Valve’s Steam, particularly “peak concurrent users” (peak CCU) as a way to compare the relative success of their favorite games.

Players post memes and speculate when popular games fall from their all-time peak CCUs, and even the games media sometimes gets in on the act, referring to sustained drops in daily peak CCU as “lost players,” even for games with an upfront price tag. Many game developers find this dynamic frustrating, with some going so far as to ask their fans to stop arguing about CCU counts so much.

To dig into this phenomenon a bit more, we asked games industry leaders behind hits like Manor Lords, League of Legends, and theHunter: Call of the Wild: “How do you measure success for your games? And how useful are CCU charts really?”

That story below. First, this week’s most futuristic news links:

News From the Future

🏈 EA Sports College Football 25 Sold 2.2 Million $100 Copies in Early Access (GamesIndustry.biz)

The return of EA’s college football series comes over a decade after the last entry, NCAA Football 14. EA reported that the game passed 700,000 concurrent players across all platforms on its first day of the paid early access. As a result, Wedbush Morgan analyst Michael Pachter said his team is doubling its sales estimate for the game from 1.5 million units to 3.2 million units.

🤖 Roblox Says New Game Genres Are Emerging on its Platform (VentureBeat)

Roblox VP Tian Lim shared some insights into what the game platform’s 77.7 million daily active users are playing, and how new genres like “roleplaying/lifesim” games like Work at a Pizza Place or Adopt Me! are emerging.

🥽 Matthew Ball Interviews Tim Sweeney and Neal Stephenson (MatthewBall.co)

Ball—whose articulation of the concept of the metaverse was enormously influential—is on a press tour to promote a new, “70%” rewrite of his 2022 book, “The Metaverse: And How it Will Revolutionize Everything.” Along the way he’s produced some fascinating interviews with leading figures building spatial computing tech. This one with Epic’s Sweeney and Snow Crash author Neal Stephenson is a can’t miss.

📺 Netflix Has 80+ Games in Development (Polygon)

During its latest earnings call, Netflix Co-CEO Gregory K. Peters said “We’ve launched over 100 games so far. We’ve seen what works, what doesn’t work. We’re refining our program to do more of what is working with the 80-plus games that we currently have in development.”

The Limits of CCU For Measuring Game Success

CCU charts never tell the full story. For one extreme example, look at Avalanche Studio Group’s theHunter: Call of the Wild, a recreational hunting simulator which, according to reliable estimates,1 has grossed over $100 million on Steam alone since its release in 2017.

This is despite the fact that the game often has daily peak CCU counts in the ~7k–8k range, and has never exceeded a peak of 24k. It took more than three years after its initial release for the game to reach 6,000 concurrent players for the first time on Steam.

And now, it’s among the 100 top-grossing games ever released on the platform.

Big Bucks, Small Charts

Kristoffer Touborg is the VP of Product for Self-Published Games at Avalanche Studios Group, which publishes theHunter: Call of the Wild. He says the game has had strong revenue growth every year since its launch in 2017.

“While we tend to not disclose specifics, our self-published games account for the majority of our annual revenue, with theHunter being our biggest current title,” Touborg says.

Touborg says that theHunter drives strong revenue from a combination of base game sales, new content like guns, and a deep back-catalog of older content. The last of these, he says, “is actually the most important revenue driver for us.”

The game’s a hit on console as well as PC, with Touborg reporting that theHunter’s player population is “almost evenly split between PC and console.” As for plans for the game’s future, he says, “we’re likely to increase our content cadence and fully expect to continue growing.”

As for the game’s usual peak CCU numbers, Touborg says that’s never been the most important metric for his team. “We’ve never chased the daily CCU, nor do I believe that we should,” he says.

Instead, Touborg says, the team behind theHunter has stayed focused on their audience.

“If you’re making a niche game, you have a demanding audience,” Touborg says. “They’ll know the niche in and out, and tend to be able to spot a team of mercenaries a mile away. theHunter came from a passionate team, who had the kind of player empathy you can only get from being a part of the community.”

The developers of theHunter, Touborg says, are “people who love hunting and the outdoors.” And that, more than the nitty-gritty nuances of the game’s systems, is what he believes has led to the game establishing a lasting relationship with its niche audience. “It’s never had best-in-class progression systems or tutorials,” says Touborg, “but it delivered on what our players cared the most about: authentic local outdoor experiences in beautiful surroundings that are so immersive that almost make you feel the wind in your hair.”

So why, then, do so many game developers and players focus on CCU charts?

“People are looking for simple solutions to complex problems,” Touborg says. “We’re gravitating towards more uniform and simple measurements at a time when the game ecosystem has become much more complex.”

In part, he says, this is because so many games defy easy categorization. “We’ve moved away from simple, opposing categories like boxed products/premium games and free to play/live service, and stepped into a hybrid era where companies mix and match characteristics in a really creative way. Did you just buy a $50 box product? Well, it probably has a battle pass, direct sales of cosmetics, and a ranked mode to keep you playing. Is it meant to be a forever live-service? Who knows.”

Touborg says this confusion has led both developers and players to judge games according to criteria that doesn’t actually make sense for the type of game it really is. “Some of the recent conversations I’ve seen around titles like Manor Lords or Helldivers have been painful,” he says, “because people talk about their success and failure in a very generalized manner, instead of deeply understanding what they set out to do.”

As an alternate approach, Touborg offers this advice for devs thinking about how to define success for their own game:

“My starting point would always be to understand what your game is supposed to do, and how your audience wants to engage with it. Once you understand that, I think you have a good foundation to define what success looks like. Like with most things in life, success is deeply personal. Most of the time, you’re racing against yourself. On theHunter we don’t talk about how we need to beat Fortnite, or how some external analyst thinks we’re not a great hunting game. We have a great product, run by a right-sized team, that’s managed to grow an amazing community over the last seven years, with no sign of slowing down. That’s success.”

But What About Live Service?

Granted, for some types of games metrics like daily peak CCU can be a critical measure of business health. This applies particularly to free-to-play, live service games with a strong PVP component, as these games need large player populations in order to offer competitors well-matched opponents.

Areeb Pirani is someone who’s spent his career working on live service PVP games. Before becoming Co-Founder and COO at Theorycraft Games, he was the Director of Strategy for the League of Legends Franchise.

According to Pirani, it’s true that longterm daily peak CCU charts tell an important story about live service games, which he says “live and die on retention.”

“If players stick around with the game,” Pirani says, “then you have time to build an audience and a business around it.”

But daily peak CCU is only part of the story. “The raw player count—especially lifetime installs, and peak CCU on Steam at launch are overrated, often intentionally,” Pirani says. “Decay from peak is overrated and oft cited, especially by players looking to prove how the game is dying.”

But what really matters, Pirani says, is whether there’s “a significant player base that continues to play, and whether that’s sufficient to fund continued improvements to the game.” Pirani says that when it comes to measuring retention, it’s “not easy to isolate from public data” like those on SteamDB.

“Public CCU data includes an unknown amount of new players coming in, old players coming back, plus regional and seasonal differences—all of which make it hard to accurately estimate retention,” he says. “The data is especially noisy in the first few weeks after launch but looking at average daily CCU after that is a decent proxy.”

But all this is just a narrow view of one aspect of the business side of the equation. The other critical factor—which you can’t necessarily divine from a chart—is the question of whether your game is resonating with your target audience in a deep way.

On this point, Pirani echoes Touborg above:

“Most developers say they are making a game for players but often their actions reflect otherwise,” Pirani says. “They may really be trying to express a particular idea they've had, bring something they've always wanted into the world, get validation from the press or their colleagues and families. Importantly the audience that they are prioritizing is not the players of their games. These motivations can lead to great art but may not draw a significant player base or sustainable business. The world is better when all types of games get made but developers need to understand and accept what they are signing up for.”

It’s becoming a theme, isn’t it? Ignore the voices and metrics that don’t matter. And focus on the audience.

A Note on CCU Charts for Steam Early Access Games

Some of the worst types of games to judge by peak CCU figures are premium games in Steam Early Access.

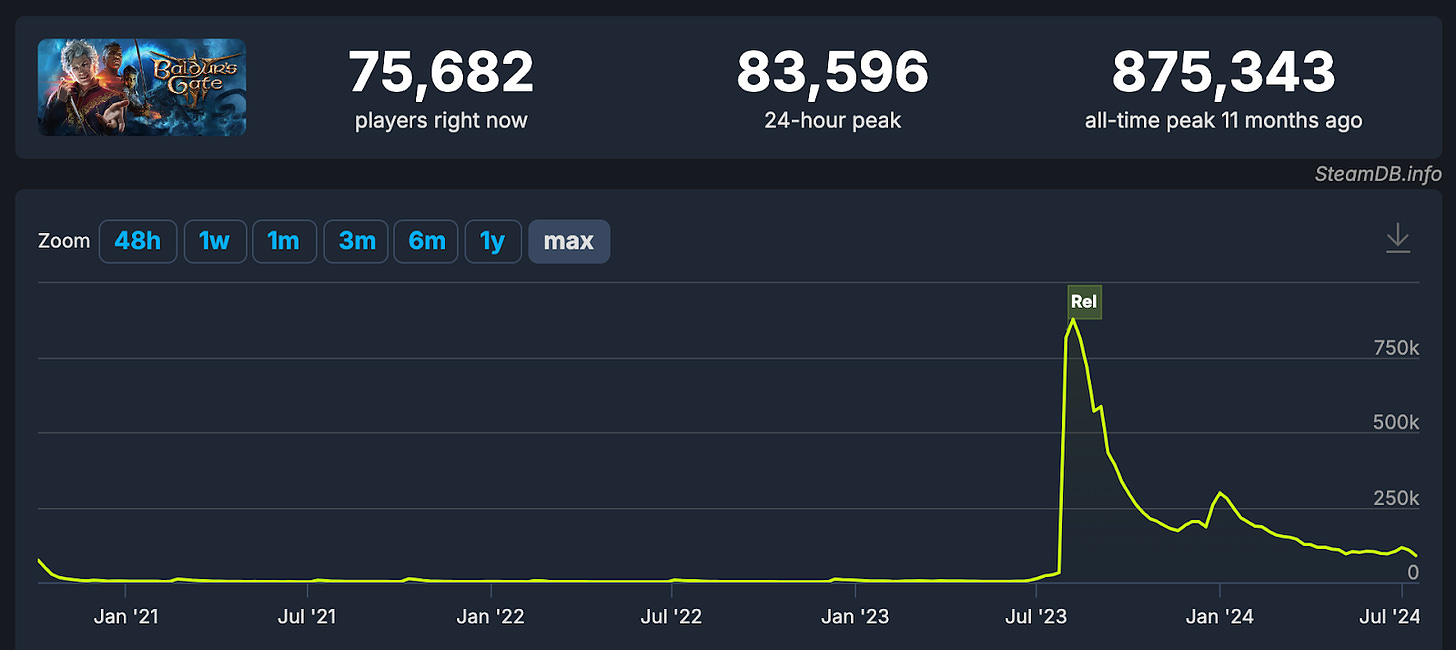

The archetypal example here would be Baldur’s Gate 3, 2023’s breakout commercial and critical hit which sold at least 15 million copies, as of the latest reports.

When BG3 originally launched on Steam Early Access in late 2020, it had reached a respectable peak of ~75,000 players before quickly trailing off to daily peak CCUs in the low thousands. That pattern held until its explosive launch last summer—likely the biggest launch of a CRPG game ever.

Clearly, the CCU chart told us little about BG3’s true potential while it was in Early Access. And even now, with its daily peak 1/10th of the heights reached at its launch, would any analyst seriously say with a straight face that BG3 has “lost” its audience? It’s a $60 game—that money is already in Larian’s bank account.

Even discussing the game’s concurrent player count is like asking how many people are currently watching Oppenheimer right now. Who cares? It grossed nearly a billion dollars.

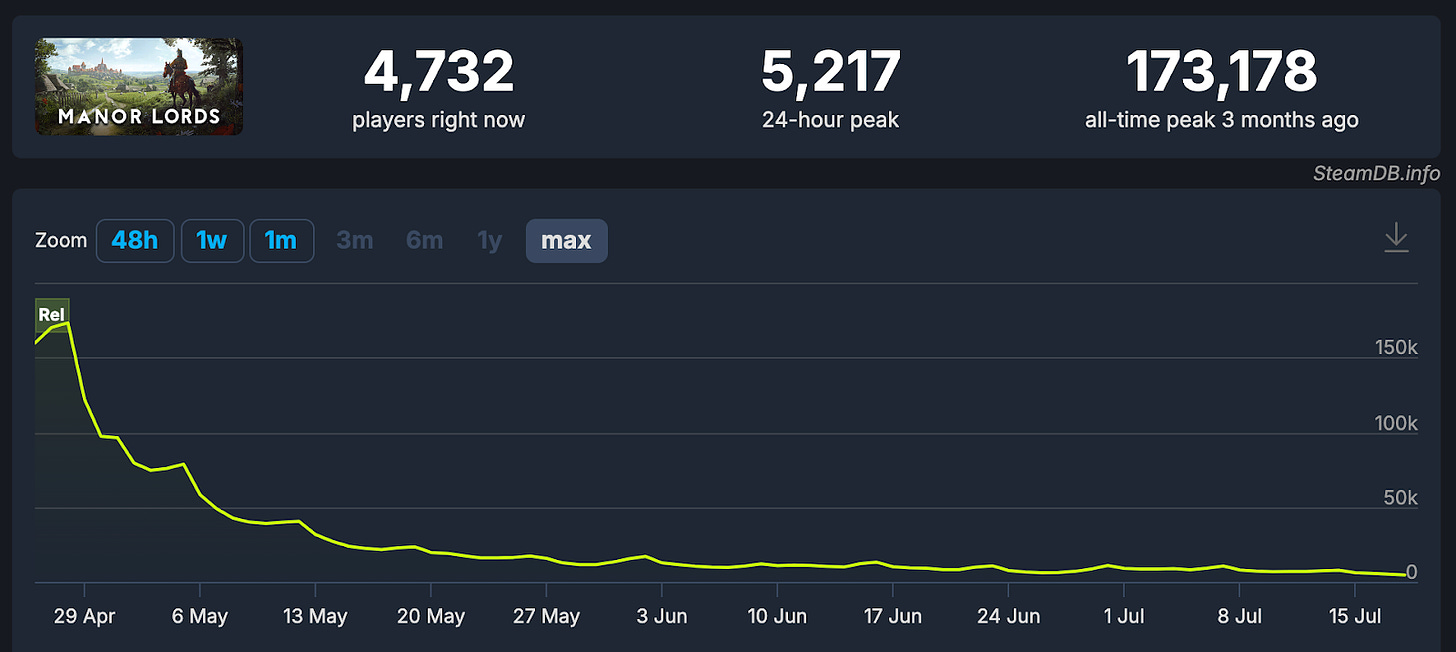

Baldur’s Gate 3 is a Steam Early Access success story, but it’s last year’s news. Let’s talk about one of 2024’s biggest Early Access success stories: Manor Lords.

Manor Lords: Premium Hit or Live Service Laggard?

Manor Lords is a medieval city builder where—basically—you get to be a feudal lord. You field armies, manage peasants, and build a community.

The game had a shockingly strong launch, especially for a small developer like Polish developer Slavic Magic. But in the weeks and months since its late April launch, the Manor Lords CCU chart has come to resemble the earliest slice of the Baldur’s Gate 3 chart, with typical peak CCU settling around 5k.

According to Tim Bender, CEO of Manor Lords publisher Hooded Horse, that CCU chart doesn’t tell the same story. In a call last week, Bender told A16Z GAMES that the game has now grossed over $60 million, and continues to sell well. “It sold about 250,000 copies in the last month,” he said.

In other words, he’s not worried about the CCU charts.

It’s a contrarian idea: shouldn’t developers want as many players as possible playing at all times? Bender says no, for a few reasons.

“CCU charts are very blunt instruments,” he says. “There's a lot of different ways in which the concurrent player chart can behave depending on what's going on in the game. You can have a concurrent player chart for one game that stays high because there’s a core set of power users who are on their 300th hour of the game. And maybe for a different game players leave sooner, but lots of new users are coming in and constantly generating sales. For a premium game, the latter is a better situation. Assuming you're getting positive reviews, and people aren't coming in and getting disappointed, then it’s okay!”

But this doesn’t mean that Bender and co aren’t paying close attention to other metrics. “Median playtime is one of my favorite measures,” Bender says, “because it avoids the problems with something like “average playtime.” Average playtime can get dragged up by a few people just playing forever, which it's great if they love it. But if you're trying to see if the game is doing well and form a strategy around it, then you probably need a more complete picture.”

Bender’s biggest concern with the industry’s obsession with CCU charts is the way that it can tempt developers to treat their games like big live service titles, even at points in the development cycle where that doesn’t quite make sense.

“If you try to apply the live service model to a smaller team doing Early Access, it'll steer you wrong in a couple ways.,” Bender says. “One way is by telling you that you should save content for post-release updates. And that would be an extremely big mistake. With a premium game, you don't care that much about saving content.”

Instead, Bender says, developers should make the absolute best first impression they can with their initial release on Early Access, so that players will be more likely to come back at full release. “There needs to be enough promise that they leave a positive review, or if they're a content creator interested in covering it they need to come away thinking it's worth paying attention to again when it comes out in version 1.0,” he says.

The other risk of treating Early Access games as a live service is the temptation to focus on the wrong things, like juicing your CCU numbers with content updates, when the game might actually need something else in order to unlock its real potential. “Maybe you need two or three months of just balancing and bugfixes,” Bender says. “It's not just about having more stuff in the game—that doesn't always make a better final product. Sometimes it's about what you remove, what you balance, and what you polish.”

And, Bender stresses, developers need time or—as he puts it—a “peaceful” environment in order to think and come up with better ideas for determining the game’s direction.

Sidebar: Simon Carless on the Metrics that Matter

Simon Carless runs GameDiscoverCo, a consulting business and excellent Substack newsletter where he analyzes go-to-market strategies for games, particularly those on Steam.

We asked Carless about his thoughts on CCU as a success metric, and whether there are other metrics developers ought to focus on less or pay closer attention to. His answer below:

There are definitely shorter indie single-player games with consistently low CCU which keep selling. A Short Hike is one example, since it seems to be at ~300k units on Steam, but has never made it past 230 CCU. Obviously, if games are short and charming, you won't get high peak CCUs, but they can do pretty decently over time.

The over-appreciated metrics for me are things like: 'lots of people enjoyed playing this at a physical event', 'lots of traditional media publications picked up the press release', and 'my GIF got 100 RTs on Twitter/X'. The under-appreciated are: 'my game adds 300 wishlists per day on Steam, even in a slow news cycle' or 'look how many TikTok likes and comments I'm getting'.

—Simon Carless, founder of GameDiscoverCo

Audience Reigns Supreme

Like the other games marketers we spoke with, Bender pointed out that any metrics you’re reading about your game have to be analyzed through the lens of your audience. You have to ask not just what a CCU chart tells you about all your players, but about specific subsets as well.

As an example, Bender points out that Manor Lords is a game that seems to have broken out beyond the core audience for games in the city builder genre. If that happens for other developers, “you aren’t just reaching the hard core than that audience. You start reaching people who are more like ‘I could play a city builder. I'm not adamantly against it and this looks like a really cool experience. I want to try it out.’”

These non-core buyers, Bender says, “will probably not stick around as much.” Games that reach beyond their core audience “will naturally have a much bigger fall off in concurrent users. while still having very strong sales.”

Bender believes that ultimately, the metrics that matter most are those that tell you whether you’re doing a good job of serving your core audience. He says he obsesses over reviews, and constantly asks himself: “What is happening with the players? What do the reviews say? Are they happy with the experience? Are they looking for more content? If so, they're gonna come back for 1.0. They're gonna try it again.”

Manor Lords is out now in Early Access on Steam.

💿 The Unlikely Return of the Video Game Demo

In this episode of "By Design" A16Z GAMES explores the past, present, and future of the game demo. Are demos a relic of the past or a necessary component in making future hits stand out?

💼 Jobs Jobs Jobs

There are currently over 100 open jobs listings across both the A16Z GAMES portfolio and our SPEEDRUN portfolio. For the freshest games industry jobs postings, be sure to follow our own Caitlin Cooke and Jordan Mazer on LinkedIn.

Join our talent network for more opportunities. If we see a fit for you, we'll intro you to relevant founders in the portfolio.

You are receiving this newsletter since you opted in earlier; if you would like to opt out of future newsletters, you can unsubscribe immediately.

This newsletter is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. This newsletter may link to other websites and certain information contained herein has been obtained from third-party sources. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation.

References to any companies, securities, or digital assets are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Any references to companies are for illustrative purposes only; please see a16z.com/investments. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund which should be read in their entirety.) Past performance is not indicative of future results.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Content in this newsletter speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see a16z.com/disclosures for additional important details.

For theHunter: Call of the Wild, our friends at GameDiscoverCo estimate gross revenue on Steam alone at over $106 million (including DLC) and total copies sold on Steam at over 6.16 million.

Understand the business model of a game (genre, monetization methods, to what extent network effect is important to the game), one can decide whether a metric is important to this game and estimate the pattern of a metric across game lifecycle.